Hugo Salinas Price: “Putin should introduce silver ruble, restore monarchy”

- дата: 13 ноября 2021 (источник от 30 января 2017)

Questions by Dmitriy Balkovskiy of Goldenfront.ru, db@goldenfront.ru

* * *

Dmitriy - here are my comments regarding the questions you have posed. I hope they are useful to you, and to your readers, to whom I send my greetings and best wishes!

1. Please tell our readers about your involvement with gold and silver money. There must be personal, ideological and spiritual reasons.

I have been an accumulator of gold since I was about ten years' old, in 1942/43; one day my father showed me a lottery ticket which had won no prize, but did win a reimbursement of the value of the ticket, which was $100 pesos. He told me he would give me the $100 pesos, and asked what I would like to do with the money. I immediately said "Buy me some little gold coins!" And so, a few days later, I was accompanied by an employee of my father's business to walk downtown to where the gold traders operated, on a sidewalk of Mexico City. There, I exchanged the $100 pesos for 10 tiny gold coins, each worth ten pesos - silver pesos, for the year was 1942 or perhaps 1943. Each gold coin contained 1.5 grams of pure gold. I put my treasure into my father's safety box at home, and there they remained for many years, until I married. I still have those coins! When I went to school in the US, at age 14, I was probably the only person that owned some gold in the little town where my school was located, because Americans had been forbidden to own gold in 1933, by President Roosevelt.

As soon as I began to earn some money, I bought more gold. I remembered the case of my father's father, an industrialist in the city of Monterrey, Mexico, whose factory was burned down by revolutionaries in the famous Revolution of 1910, but which he was able to rebuild after the Revolution, because he had had the foresight to hide 100 gold coins, each with 37.5 grams of pure gold. He had hidden these coins in the walls of his home.

My father, at one point in his career in business, also had an important lot of gold as protection against the devaluation of the peso, which has had only temporary stability since the Revolution. When he was born, Mexico was on the silver standard and the coins used to pay the midwife at his birth, were coins with the same silver content - about 24 grams - that they had had since silver began to be minted in Mexico in ¡1535! A remarkable case of monetary stability, in a country which was happy, content and prosperous under the rule of the succession of viceroys appointed to rule Mexico as a part of Spain; Mexico continued to use the coins with the same content of silver, but with different markings, after the viceroys departed and Mexico became independent.

Our first ruler after Independence from Spain was Agustin Iturbide, who was named "Emperor of Mexico" in 1822, as having an Emperor was the most natural form of government for our nation, following the tradition of rule by viceroy. But, then began the nefarious interference of the US in our national life. The US ambassador moved the politically innocent Mexicans to depose the Emperor, because the US did not want a strong Mexico. It has been our misfortune to have the US as our next-door neighbor, for soon followed the loss of Texas to the US in 1836, and then in 1847, the loss, in a war with the US, of half of Mexican territory, which is today "the West" of the US. These are only some of the misfortunes which the US has visited upon us. Among them is "democratic government by elections" which have been generally ruinous and place us in a condition of weakness next to our belligerent neighbor.

And now, we have another aggressive US President who thinks he can bully Mexico into "paying for the Wall" which he wants to build between the US and Mexico. There appears to be no end to the damage that the US has caused Mexico. Far worse yet, I can visualize US military entering Mexico, ostensibly to fight with the "Drug Barons" who send drugs into the US.

Now more than ever, my foresight in holding my savings in gold will be a life-saver for my grandchildren, because with Trump as President in the US, we are going to face very hard times: he wants to revoke previous international agreement of "North American Free Trade Agreement" or NAFTA, and that will cause the ruin of much Mexican industry, established to produce exports to the US.

I should like to point out one fundamental evil of the present monetary system of the world, based on the US Dollar after the Bretton Woods Agreements were signed in 1944. Under this system, it turns out that all countries have to have dollar reserves in their central banks, and since we can only get dollars by exports, we are obliged to have a positive favorable balance of trade in order to have those dollars. If the US deprives us of exports, our monetary system will collapse, for lack of dollars. So you see, that the present monetary system - established as I have said, under US pressure at Bretton Woods in 1944 - all countries in the rest of the world are placed in a situation where their "center of gravity" is not within their own territory; our "center of gravity", like all other countries, is outside our borders, as we require exports to survive - no exports means no money for Mexico, and this applies to all countries of the world. This is a totally unhealthy and destructive situation. We cannot create our own independent prosperity within the confines of the Mexican territory: we must export! And now - the receiver of our indispensable exports, wants to cut them off. The US blames Mexico for exporting too much to the US, where the fact is, that the system which forces us to export, was established by the US itself.

At an early age, I learned from my father - not in any school! - the doctrines of a great economist, Ludwig von Mises, who was of the Austrian School of Economics (ironically, a great School almost unknown today in Austria); also, I learned much from the articles of a well-known journalist, Henry Hazlitt. He wrote a book for beginners interested in Economics, with the title "Economics in One Lesson". I think it should be translated into Russian, by the way. An excellent primer on Economics - true Economics, and not what is taught at all the principal universities of the world, the false doctrines of John Maynard Keynes. Keynes has made all his students, which include the most famous names in Economics today, into men and women who really do not know what they are doing. But like so many Academics, they are blind to their falsities and extremely proud of themselves and will not listen to any criticism.

Today, the teachings of Ludwig von Mises have been improved in some very important points by further thinking on the part of today's greatest economist, a Hungarian, Professor Antal E. Fekete. His very important work, "A Critique of Mainstream Austrian Economics in the Spirit of Carl Menger" is available on his website, professorfekete.com (See here).

Gold and silver have been money for thousands of years, and yet our Academics are so blind that they really think they can do away with what they call money - papers that are essentially no better than the Trillion Dollar Zimbabwe notes of Mugabe in Africa - and have us all carry on with digital "money" through credit cards. When they have achieved this, they will find that people will resort, once again, to gold and silver to carry on their lives and their business. But, the Academics cannot see this.

I am not too well-informed on this, but if I am not mistaken, Vladimir Lenin introduced a silver ruble coin to Russia, as well as a gold coin, the Chervonetz. So even a Communist like Lenin understood that there must be real money in the hands of Russians.

2. Now to Russia. What is your view of this country? Do you think Russia and not, for example, much more overtly gold-friendly China could be the place where the monetary role of gold and silver is restored?

My view of Russia is quite simple: I think Russia is the last hope for survival of what is known as "The West". Quite miraculously in my opinion, Russia has returned to life as a Christian nation. The West was born of Christianity and will cease to exist without it, a process which we can see in operation in the news of every day. Russia is fundamentally a part of the West, and at present is mainly separated from Europe by the interests of the US and of the UK, who have a deathly fear of such a collaboration. A Europe that would join Russia in peaceful collaboration, would be joining a Russia-China collaboration that is presently growing to develop the vast potential of the Eurasian landmass. I think that Europe will eventually join Russia in peaceful collaboration, to form an economic area from Finisterre to Vladivostok.

Quite contrary to the hopes of US geo-strategists such as Brzezinski, the "Sanctions" imposed upon Russia (to the detriment of Europe) have only resulted in the further strengthening of Russia, as under "Sanctions" Russia has turned inward to advance its national productivity and become stronger, not weaker. And the attempt to weaken Russia, by having Russia enter Ukraine in a war to retain control of that country, failed to entice Russia into that conflict.

According to my limited knowledge, Russia has managed its economy quite carefully, and now has enough gold to abandon the dollar completely with a return to gold money. For this, see the article on the subject by my friend John Butler: his e-mail address is john.butler@goldmoney.com

The amount of debt outstanding in Russia is also quite low, which also is a sign of good government.

These facts lead me to believe that Russia could return to gold in some form, at the appropriate moment. China has an enormous stock of gold, a fact which it prudently hides, and has also been encouraging its population to acquire gold as a means of savings - unlike the countries of the West, which are deadly enemies of gold, which is true money. However, the amount of debt in China is simply colossal and it is this fact - in my opinion, of course - which makes it more likely that Russia will opt for gold money before China does so.

China was on a silver standard - silver was used as money - until about 1935, when the US decided to raise the price of silver. This had a disastrous effect upon the Chinese economy, for its silver money rose in value, and in a perfect world, silver prices of food and wages would then have to fall correspondingly, with no harm done. But ours is not a perfect world, and it is politically impossible to have the price of wages in silver fall; thus, marginally employed people were laid off, as it was impossible to continue paying them the same amount of silver as wages, when the value of silver had risen. Thus, silver was demonetized and China went on to a paper standard. I think it is likely that the ordeal that China suffered with the rise in the price of silver - a great deflation accompanied with massive unemployment - furnished the political unrest that Mao Tse Tung harnessed to take over China.

I have read that General Chiang Kai-shek had a large amount of silver in his possession as he fought Mao, but he made the mistake of keeping the silver to himself, and paying his soldiers with paper money. The soldiers would not risk their lives fighting the Communists, when paid with paper. And so, Mao won.

Under President Trump, the US is making some very big mistakes, which will turn out to be favorable to a return to gold as money around the world.

a) The US is turning inward, ostensibly to re-industrialize itself. Mr. Trump's motto: "America First" says it all. As it turns inward, the US is intent on raising barriers to international commerce. This move cannot be reconciled with the idea of the US as a world leader. The world leader cannot be a country that cuts itself off from international commerce: on the contrary, it becomes irrelevant.

b) If Mr. Trump continues his attempt to reduce the Trade Deficit, what he will achieve will be an increasing scarcity of dollars around the world, for the US Trade Deficit is the spring from which flow out dollars to the rest of the world. The world is already in a credit contraction, as evidenced by the declines in International Reserves in central banks of the world - down 10%+ from the peak reached in August, 2014. Add to this the scarcity of dollars which Mr. Trump wants to produce, by cutting down on the US Trade Deficit, and you have a catastrophic scarcity of dollars for the world.

The world, in my opinion, will not tolerate this scarcity and will turn to an alternative. The SDR - Special Drawing Rights issued by the International Monetary Fund, called "Paper Gold" - will be one more paper money attempt to replace a worn-out paper money, the dollar. I do not think that this attempt will be successful, and another more down-to-earth alternative will be sought.

There is only one alternative of such a nature: gold. So the next few years will be extremely interesting, as the monetary system established in 1944 falls apart. From a pessimistic point of view, it would seem that such a development would normally be accompanied with war. However, the next world war would be the last one in history. We hear that Russia is very well protected with the S-400 and the S-500 anti-missile batteries in place, sealing off its borders from incoming missiles. I hope this is true.

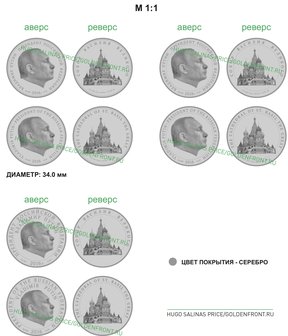

3. Please tell us about your silver ruble proposition.

Variations on the theme of silver ruble

I got to thinking about silver money for Mexico, way back in 1995, when we were suffering from another monetary disaster. Why did this happen? Why did we have recurring monetary problems, when we had had a long history of monetary stability?

Of course, the cause of our continual problems with money that dissolved in value, was that we used paper money which was created at will by our Central Bank, to provide funds for our governments which could never, ever live within their means, with an exceptional period of stability when we had some good governments during the period 1954 to 1976, when our exchange rate remained stable at $12.50 pesos to the US dollar. (We are now at over $21,000 pesos to the dollar, in terms of the peso before three zeros were eliminated from its value in 1993.)

My thinking was: How could Mexico have a currency that would not devalue?

Since it was politically impossible for Mexico to abandon the dollar and go to gold, I thought that a parallel currency, based on silver, would be a solution.

Mexico would have two currencies circulating in parallel - the paper money, subject to devaluation, and the silver money, which would be immune to devaluation.

But how to turn silver into money was the question. I struggled with this problem for months, until finally, one night, the solution came into my mind: silver can be turned into money by means of a monetary quote, which will take the place of a stamped value upon the silver coin. In devaluation, the stamped value on the silver coin would soon become obsolete, as being less than the value of the silver contained in the coin. So the silver coin would have to be given a quoted value that would rise as the paper peso devalued, and I thought this quoted value should be given to it by our monetary authority, the central bank.

This silver coin, with a quoted monetary value, would have an increasingly higher quote given to it as the devaluation of paper money continued.

We see monetary quotes for stocks and bonds, why not for the silver coin?

Now if the silver coin were given a quoted monetary value, this quote could never be reduced. It could remain stable, or increase, but never decrease.

The public would scramble joyfully, to own this silver money with a quoted monetary value. Security, stability in the value of savings, for the Mexican people.

The Mexican Congress was very interested in the measure, and during three successive Legislatures, the proposal was supported by various political groups.

However, nothing came of the measure, which would have been so beneficial to the population, due to the absolute refusal of the Central Bank to accept the idea. Not without reason, do many thinkers in Mexico consider that our Central Bank is Number 13 of the 12 Branches of the Federal Reserve of the US.

Thinking of Russia as the single, great remaining nation of what was once "The West", I thought that the Russian people would also welcome, with great joy, the possibility of putting their savings into silver money. I still think this is possible, and I put my thinking into a series of articles dealing with the monetization of the silver ruble coin. I had planned to present these articles at a meeting of the St. Petersburg International Economic Forum - SPIEF - in June, 2016. However, on account of illness it was not possible for me to be present. I do not wish to continue to harp upon the proposal; I presented my thoughts, and they are surely in the hands of responsible persons, and I must defer to their judgment on a matter which affects Russia internally, however much I believe in the value of my proposal. Perhaps - after I am gone - my proposal may be put into effect in Russia.

As a postscript, now that Mexico is in grave problems, due to the tempestuous decisions of Mr. Trump, our Congress has revived - motu propio - of its own accord, the proposal of a monetized silver coin for Mexico.

The national indignation at the treatment the Trump is giving Mexico, has produced a wave of national feeling that may, perhaps, give life to the proposal of a parallel currency based on the silver coin as money. I think it would be a master-stroke of "asymmetrical" politics, and would elevate to the skies the prestige of Mexico around the world. Many millions of Americans who have been saving large amounts of silver coins would be thrilled to hear that Mexico had monetized a silver coin.

We shall see what transpires in the coming weeks and months.

4. Could Putin become the new St. Constantine? Is there a chance?

I really cannot answer your question. I do consider Vladimir Putin as the world's greatest living Statesman. After he is gone, he will long be remembered by Russia for his greatness; of that I am convinced.

In my opinion, Monarchy is the most natural form of government. No other system of government can compare to the benefits for the governed, of the rule of a good and wise man who rules with support of a Christian population.

Of course, with a hereditary monarchy there is the problem that the character of the ruler that inherits power may not be one of wisdom and goodness.

Under the system of the Roman Empire after Hadrian, who was a wise and good man, the ruling Emperor adopted as his son and heir the man most likely to be a good and wise ruler. The most important rule was that the heir should not be his physical son, but only the most qualified individual, who was to be adopted as son. Thus Rome rose to its greatest point under a series of excellent rulers, whose objective was not to wage war, but to stimulate trade, create prosperity for the governed nations of the Empire, and build beautiful cities. The last of these emperors was Marcus Aurelius, famous for his memories, who made the grievous mistake of transferring power to his physical son, Commodus, who turned out to be a terrible ruler.

Perhaps this example might be of benefit to Russia: to have Putin name as his heir, the individual most qualified to rule Russia, instead of leaving the question to the decision of a popular election. However, such a measure would go against the prevailing thinking of the Russian people, which I assume is in favor of the great fallacy of "Democracy". I call Democracy a fallacy, because Authority cannot arise from the lower stratus of society, Authority is a quality that belongs to the wisest: children cannot rule the family - the family must be ruled by the father who knows best what is good and convenient for the family.

With these thoughts, I leave the subject of rule of Russia after Putin.

5. Your view of the future - will the financial collapse destroy what used to be called Christendom, the whole world? Will there by a noticeable collapse or a slow downward slide? Is modernity over?

I think a financial collapse is already under way, and will gather speed with President Trump's present policy, of which I have already spoken. The financial collapse will destroy enormous quantities of paper wealth, but it will not destroy the wealth of those owning physical gold or silver. At some point, Russia or China, or both together, will turn to the enduring alternative, gold for large transfers of wealth, and silver for use by individuals in their day-to-day transactions, as has always been the case. When gold is again the world's money, the silver ruble coin will have to be incorporated into the system of gold money at a floating rate of exchange; what caused previous problems was the attempt to use both metals as money, simultaneously, with the idea that silver must have a fixed rate of exchange against gold.

Gold is actually money today, but its use as money has been forbidden by making it subject to taxation in economic exchanges. The reason it is money, is that gold has the lowest fluctuation in commercial transactions: of all things that can be used as a medium of exchange, gold has the lowest - practically nil - fluctuation in value as the volume increases; in other words, among all substances, gold enjoys the lowest rate of decline in its marginal utility. What this means is that whether you are negotiating a purchase with one gold coin, or with a million gold coins, there will be no discount applied to the delivery of one million gold coins. With silver this is not the case. The payment of a large amount of silver may quite naturally be subject to a discount in the value of the amount of silver to change hands.

The market will determine the rate at which silver can be exchanged for gold. When I say "the market", I mean that the value of silver with regard to gold is not a matter for governments to determine. Sad to say, we are living in an age which hardly believes in the efficiency of free markets. However, the people are the market, and it is the people who will decide the correct exchange rate for silver against gold.

As the world financial crisis begins to manifest itself in the destruction of the value of all the paper money "wealth", it is my view that Russia or China, or both together, will find themselves forced to turn to gold as money, as no other alternative will be available. When gold is again recognized as being the only true money, it will have no price itself, because all prices of all things will be gold prices. What gold will have, will be enormous purchasing power!

The age in which we live, in which the US dollar has been really the world's money, is coming to a conclusion. What is thought today to be unthinkable - gold as the world's money - has thousands of years of experience on the part of humanity to its credit. Our age - from 1944 to the present - has been living in an artificial world for only 73 years. The artificiality of our age has only existed for an extremely short period of time. It is now coming to an inevitable end. The return to Reality will, indeed, be painful for many millions who have been terribly deluded by the handlers of the present monetary system. But the world will not come to an end. What will end are fantasies such a putting men on the Moon, and planning on human visits to Mars. As Voltaire once said, "We must tend to our garden". Voltaire also said, "Paper money always returns to its intrinsic value: zero." In this sense, the "modernity" which you mention, which is only 73 years old, will very soon be over.

6. Your advice to our readers in Russia and the rest of the world.

All thinking people should be aware of the terrible fragility of our world, that has operated on artificial money for 73 years. It is in process of falling apart.

Gold and silver are extremely cheap and can be obtained by paying for them with paper. I think this present situation will change drastically in the next few years, or perhaps much sooner. It is better to be ten years early, than a day late!

Комментарии 0

Добавить комментарийПожалуйста, войдите или зарегистрируйтесь, чтобы оставить комментарий.