Chris Hamilton: “Demography is our death sentence”

- дата: 29 апреля 2019 (источник от 28 апреля 2019)

Chris, the main area of concentration in your work is the great demographic transition the world is going through and its impact on the economy and markets. What motivated you to begin your research? Why demography?

The reason I chose demography...I studied history and political science in college and always had a certain amount of intellectual curiosity. I was fortunate enough to work for Nike and than Adidas, which were both very active globally, from sourcing, manufacturing, marketing, and sales in nearly every global currency. I was managing product development during massive surges in oil prices, rubber prices, labor prices, currency fluctuations. etc. The product development cycle (from brief to shelf) was something like 18 months...but as we were moving along attempting to build the product, the swings in input prices, labor, and currencies were so severe it was becoming farcical to build quality product and know there would be an acceptable margin and profit, at the end of the day. At the same time, my own assets (a 401k and starter home) were riding massive waves of appreciation and depreciation through '00 and again in '08. I met with an certified financial planner and he explained that I should just keep on investing, because in the long run everything goes up...apparently 7% to 8% annually?!? I went home and mapped that one out and immediately knew, this was impossibl "over the long run". I began reading as much, as time would allow, to understand what was happening and driving such commodity and asset undulations. Honestly, I didn't find a single analyst or expert that could help me make much sense of this. And that is where things got strange.

Unknowingly to myself, my wife, or most my friends...I began a journey down a rabbit hole without realizing how far and how long I would be going. I began by digging into commodity consumption, depletion rates, and the possibility of peak oil. Likewise, I chased ideas for finite resources like fertilizer, metals, etc. I chased currencies, debt, interest rates, productivity, dug into trade deficits, went deeply into the Treasury market, etc. etc. Independently, none of them made sense. I wasn't until I started backing into population growth and demographics that a red thread began to emerge, running through all the different elements I had looked at.

As I unknowingly began my career as an amateur demographer, everything began making sense. The US and global interest rate curves and policy, the rise of federal debt, etc. etc. 50 years of negative birth rates of the consumer nations leading to declining child bearing populations, masked by the baby boom surge of elderly living up to two decades longer than their parents, meant the population pyramid was flipping. A small and declining base was set to support a large and growing top...coupled with underfunded pensions and means to support the elderly in retirement. And as the population base growth decelerated, so too should economic activity...and asset appreciation. But central banks, federal governments, and those who placed them in power, were not about to settle for what little growth was organically possible due to these changes. They implemented interest rate policies, tax policies, federal deficit spending policies to pull demand forward. And once they had pulled forward all the growth that would come, they began pulling forward growth that would never actually exist. China used debt to build infrastructure, factories, and housing for a population that is never coming, The US, EU, Japan all attempted to policies to push corporate profits and asset appreciation into the stratosphere. Simultaneously, an ongoing growth in organic deflation met with like and growing hyper-inflationary policies to achieve upward market trajectories.

What is your main thesis in several phrases?

The consumer nations of the world represent 50% of the worlds population, have 90% of the income / savings (plus access to credit), and consume 90% of the worlds energy, exports. So goes the growth of the populations, demographics, and business cycles of the consumer nations, so goes the ability of the poor nations of the world to export their way out of poverty. The decelerating under 65yr/old annual population growth (and now outright population declines) among the consumer nations is organically creating declining demand. Only through cheaper and greater debt can "more" be consumed. But a tipping point is rapidly approaching where declining working age populations and consumer bases will not be capable of consumer more, regardless zero interest rates and greater availability of debt.

Which developed countries are the most demographically healthy and which are the sickest?

At

this point, what matters is who has the income, savings, and access to

credit...plus military might. N. America, Europe, and NE Asia have nearly

all the important currencies, consumer bases with the income, savings, and

access to credit...and hugely negative birthrates. Russia, the US,

Brazil, Mexico, S. Korea, Germany, Italy, Spain, China, Japan, etc. all are

seeing massive declines in total births and birthrates. The asset

boosting policies of central banks and federal governments also seem to be

responsible for the accelerating decline in birth rates. Asset price

appreciation benefits institutions and those holding assets (primarily wealthy,

elderly persons and institutions). The same policies punish those not

holding assets; the poor, the young, those of childbearing age. Suring

housing prices and rents, education costs, insurance, services, etc. are

eating an abnormally high percentage of younger persons income.

Simultaneously, younger persons income are rising nowhere in-line with the

rising costs. Add to this the record student loan crisis in the US, and

young are waiting longer than ever to get marry and having fewer children than

ever.

Given spending is driven significantly higher by the size of the family; present and future consumption is being sacrificed for present asset appreciation. The longer the negative birthrates and lower the immigration, the greater the in-organic measures undertaken. Japan and Germany were first, and both implemented policies to allow greater exports while the consumer base in their home nations fell. Japan, via currency, and Germany, via the Euro, were able to maintain growth via a still growing consumer nations population. China followed on but due to the slowing consumer nation growth, had to undertake greater domestic mal-investment (like Japan) to keep the wheels turning. But now, global consumer decline is the new norm...and exporters have a declining consumer nations market to export into. It is now a fight for a shrinking pie. Globalism and reducing trade tariffs among consumer nation depopulation no longer makes sense.

What demography tells us of prospects of China and the Islamic world.

China, Japan, S. Korea, Taiwan are all likely to see population and economic collapse (perhaps within a decade?). The population declines in NE Asia are staggering and inescapable...and irreplaceable globally. As for the Islamic world, they are a mixed bag. The Islamic world, is following the global trends to lower birth rates. Only the poorest and most impoverished Islamic nations (plus sub-Saharan Africa) continue to have higher, but trending lower, birthrates. Most these nations are entirely dependent on global growth and investment for their own economic growth...and so goes the decline globally, so goes their prospects. Militarily, these nations appear to have no offensive capabilities and present little to no credible threat much beyond their borders. As for Saudi Arabia and other oil dependent Islamic and non-Islamic nations alike (Mexico, Russia, US, Canada, etc.), it is a race between declining consumption among consumer nations and declining exploration, depletion rates, and output of production nations (with a kicker of ever lower rates incenting ever greater debt fueled capacity).

In your latest post you talk about labor participation rate in the United States and forecast a recession, but President Trump says that the economy is fine and will be fine – why such divergence of opinions?

Simply put, working age populations drive consumption and housing creation. With minimal working age population growth and full employment among the working age population...no more persons are available to enter the labor force and employment can grow no further. Without more employees, no further growth in consumers, no more home buyers. Every time the labor force is fully employed, as it is now, recession is imminent due to lack of further available growth.

What is your one favorite diagram on demography and economics?

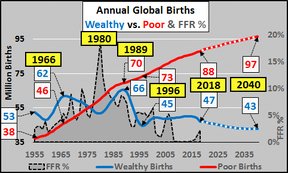

First chart is total annual global births by the wealthy nations that make up 50% of the worlds population versus the poor nation births. So important to note that 90% of income, saving, and access to credit plus 90% of energy consumption is among the wealthy nations with long declining births and child bearing populations...

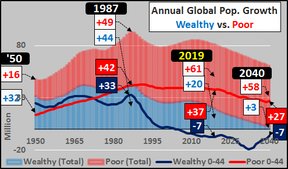

and breaking out total annual population growth, again

by wealthy and poor plus the breakout of annual growth of under

45yr/old wealthy and poor.

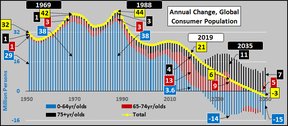

Consumer nations total annual population change, by age group

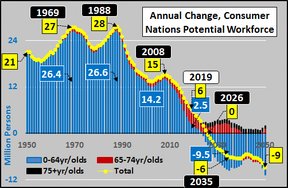

Consumer nations annual potential workforce change, by age group and labor force participation rate...the potential growth of the workforce will be zero by 2026 and falling indefinitely after that.

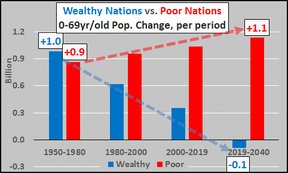

Wealthy vs. poor nations 0-69yr/old population growth, per period

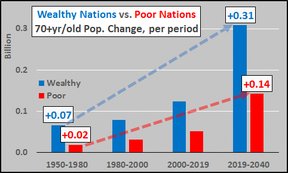

70+yr/old wealthy vs. poor population growth, per period

The world economy in the next 30 years, main directions of change – your forecast.

Depopulation, deflation, depression...and every possible contrary policy and action by central banks and federal governments to continue asset appreciation and create inflation. Every inflationary action will likely deepen the depopulationary wave, increase capacity versus falling consumptive capability, and worsen the long term situation to kick the can until it will go no further.

Your advice to our viewers

Nobody knows how this will work out but best guess is minimal debt, maintain exposure to equities, RE, bonds (likely to continue going up but for all the wrong reasons), hold some amount of cash and/or crypto...and hold physical gold and/or silver as an insurance policy for if/when it all goes wrong.

Комментарии 0

Добавить комментарийПожалуйста, войдите или зарегистрируйтесь, чтобы оставить комментарий.